Bitcoin: After weekend dip, chart watchers share crypto clues

Bitcoin has but to get better from its unexplained weekend swoon, and now the investing public is on edge in regards to the notoriously risky token’s subsequent transfer. Enter the chart watchers.

Noting that “a chart is a chart is a chart,” Tallbacken Capital Advisors’s Michael Purves despatched a observe Wednesday with a technical evaluation of the coin’s buying and selling patterns. Bitcoin’s current highs weren’t confirmed by its relative power index, amongst different issues, and its upward momentum is fading, he stated.

“From purely a technical perspective, the bullish case appears extremely challenged right here within the close to time period,” after its current rally, wrote Purves, chief govt officer on the agency.

It’s one other signal that Bitcoin has develop into too massive for Wall Street to disregard. With extra companies permitting prospects to dabble within the asset and extra institutional cash tied to its efficiency, no surprise chart watchers are capitulating and now lending their experience to the rising batch of research.

Earlier, JPMorgan Chase & Co.’s analysts additionally chimed in with their take. The previous couple of instances Nikolaos Panigirtzoglou witnessed such damaging worth motion in Bitcoin, consumers returned in time to stop deeper slumps. This time, the strategist is frightened.

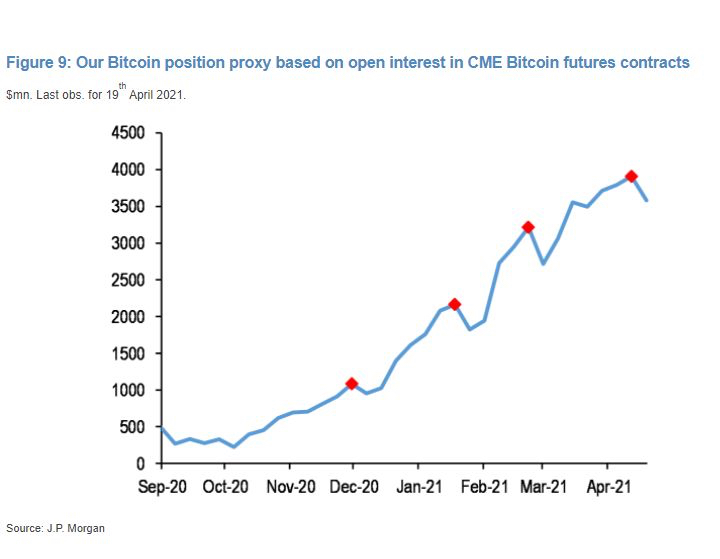

If the most important cryptocurrency isn’t in a position to break again above $60,000 quickly, momentum alerts will collapse, strategists led by Panigirtzoglou wrote in a observe Tuesday. It’s doubtless merchants together with Commodity Trading Advisers (CTAs) and crypto funds have been at the least partly behind the buildup of lengthy Bitcoin futures in current weeks, in addition to the unwind in previous days, they stated.

“Over the previous few days Bitcoin futures markets skilled a steep liquidation in a similar way to the center of final February, center of final January or the top of final November,” the strategists stated. “Momentum alerts will naturally decay from right here for a number of months, given their nonetheless elevated stage.”

In these three earlier cases, the general circulation impulse was sturdy sufficient to permit Bitcoin to shortly escape above the important thing thresholds, yielding additional buildups in place by momentum merchants, JPMorgan famous.

“Whether we see a repeat of these earlier episodes within the present conjuncture stays to be seen,” the strategists stated. The probability it’ll occur once more appears decrease as a result of momentum decay appears extra superior and thus tougher to reverse, they added. Flows into Bitcoin funds additionally seem weak, they stated.

Bitcoin rose as excessive as $64,870 across the time of the Nasdaq itemizing of Coinbase Global Inc., however has retreated again to $55,000. The cryptocurrency continues to be up about 90% year-to-date.

The coin, down 5 of the final six periods, is struggling to overhaul its 50-day transferring common round $56,819. For many chartists, that’s a bearish indicator because it tends to find out worth momentum tendencies. Should Bitcoin be unable to breach its short-term pattern line, it may transfer decrease and check the $50,000 stage, a few 10% decline from the place it’s at present buying and selling. The subsequent space of help could be its 100-day transferring common round $49,212. That would signify a 11% retreat from Wednesday’s buying and selling ranges.

Tallbacken’s Purves, who says the coin’s 2017 breakout and subsequent decline is a helpful case research, additionally factors Bitcoin’s each day MACD sign — or the transferring common convergence divergence gauge — which has turned bearish within the intermediate-term. And its efficiency continues to be correlated to Cathie Wood’s uber-popular ARK Innovation ETF.

“Trading Bitcoin on the bullish facet proper now doesn’t seem to have favorable risk-reward and if in case you have made income, it looks as if a superb time to go to the sidelines for now,” Purves wrote.

To be certain, he stated, it’s troublesome to conclude how a lot additional it may decline. Key to the difficulty will probably be how strongly institutional consumers step in. “While upside momentum is clearly trying challenged right here, it’s inconclusive how a lot draw back threat stays,” he wrote in a observe. “It is totally attainable that Bitcoin may merely consolidate in a variety for a while.”

Bitcoin fell as a lot as 4.3% Wednesday to $54,341 earlier than recouping some losses. Smaller and different cash that had run up in current days additionally suffered declines Wednesday, with Dogecoin — the poster-child for crypto risk-taking — declining roughly 15% to commerce round 31 cents. That’s down from a excessive of 42 cents the day prior, based on CoinMarketCap.com.